Company Car Benefit Malaysia

The definition of employment income in the Income Tax Act 1967 ITA is very wide and comprehensive. In a world of alternative transportation options high mobility and turnover companies are considering how their benefit policies define or differentiate their employment brand.

List Of Tax Deduction For Businesses Cheng Co Group

Learn about Philip Morris International Company Car including a description from the employer and comments and ratings provided anonymously by current and former Philip Morris International employees.

. This means that these benefits cannot be converted to cash when they are given to the employee. This came into effect on 1 January 2021. Other mandatory benefits outlined in the Act include.

Getting A Tax DeductionTax Incentive For Your Company. 2022 MALAYSIA BENEFITS SUMMARY. Hiring disabled worker - Employers are eligible for tax deduction under Public Ruling No.

Employees are eligible for most benefits programs on the first day of employment. BIK are non-monetary benefits. They eligible to apply for individual corporate fleet discount for a car purchase under individual registration.

Employees shall be granted 13 vacation days on a prorated basis for less than 2 years. P11d value is a car valuation that includes VAT and delivery charges but excludes the first registration fee and road tax. INLAND REVENUE BOARD OF MALAYSIA BENEFITS IN KIND Public Ruling No.

37 x GDE 045 per km x private mileage if employee pays for the cost of petrol. Apply for a car insurance on RinggitPlus for exclusive gifts. What is Benefit In Kind BIK.

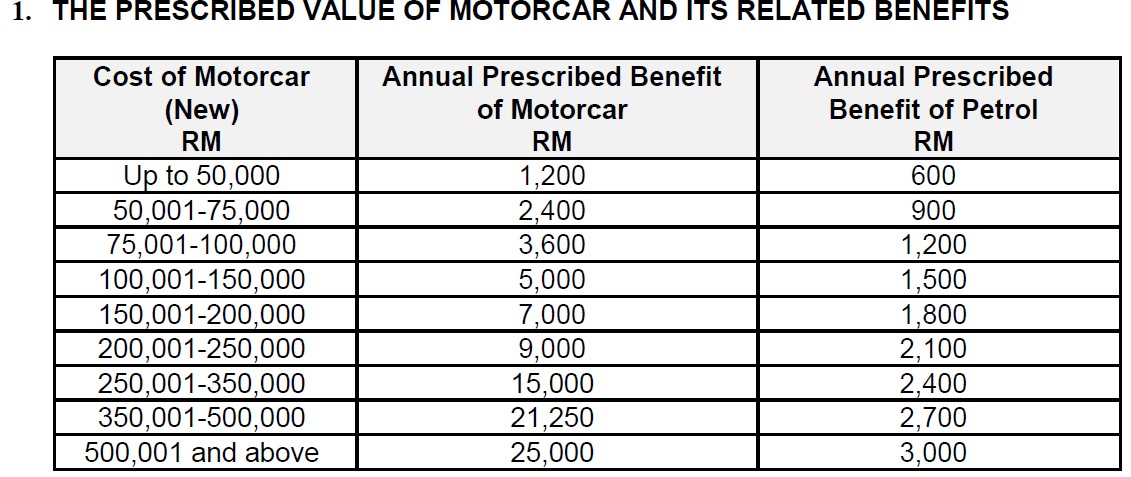

Glassdoor is your resource for information about the Company Car benefits at Philip Morris International. Motor cars provided by employers are taxable benefit in kind. 32019 of Inland Revenue Board of Malaysia.

The benefit in kind tax rate also known as the BIK rate is determined by a variety of factors such as the drivers tax bracket the cars CO2 emissions and fuel consumption and the vehicle P11d value. 12 December 2019 Page 5 of 27 However toll fees which are paid by the employer is regarded as inclusive in the value of the BIK on the motorcar. Manage car benefits across your international workforce by comparing typical practice across 10 industries.

The Tax Cuts and Jobs Act effective 2018 and beyond no longer allows employees to deduct any business expenses that arent reimbursed. Covering all forms of remuneration including the value of benefits-in-kind BIK provided by the employer for the personal use or enjoyment by the employee. Compare car benefit practices across global industry standards.

This scheme is tailored for individuals and corporate executives who are currently receiving a company car benefit or individual car allowance as part of their employment package. Fringe benefits inclusive usage of Company vehicles medical insurance and clothing allowances. NFM issued by Mercedes-Benz Malaysia.

These non-monetary benefits are considered as income to the employees. Aside from the benefits above which are listed in the guideline employees are encouraged to offer the following benefits too. The list goes as follows.

Yes there is a tax deduction for employers in Malaysia subjected to the terms and conditions set by the LHDN. 112019 Date of Publication. BIK benefit in kind are benefits provided by the employer to the employee in forms of services vehicles and lodging.

The value of benefit derived from an existing car with renewed COE is computed as follows. All insurance Buy online Comprehensive 3rd party Fire theft 3rd party e-Hailing. Apply for a car insurance on RinggitPlus for exclusive gifts.

Compare car insurance quotes and plans with flexible coverage of loss and damage due to accident fire and theft. If you give an employee a company car and you dont reimburse them for driving expenses the employee cant deduct those expenses on their personal tax return. Maintenance costs such as servicing repairs annual road tax and annual insurance.

Fixed retainer fees to Non-Executive Directors for their contribution. 1800 645 186 Sydney 61 2 8864 6800 International 0508 645 186 Auckland 64 9. If employer pays for the cost of petrol use the rate of 055 per km instead of 045 per km.

Allowances to Non-Executive Directors for attending during the AGM or EGM. Previously these expenses could be deducted on. Transportation Policies and Costs Bundle.

Car with Renewed COE. The Types of General Employees.

Company Car Benefit Should I Declare It On My Income Tax Filing

Benefits In Kind Bik In Malaysia Hills Cheryl

List Of Tax Deduction For Businesses Cheng Co Group

What Is Bik In Malaysia How To Calculate Bik What Is Benefit In Kind

List Of Tax Deduction For Businesses Cheng Co Group

List Of Tax Deduction For Businesses Cheng Co Group

0 Response to "Company Car Benefit Malaysia"

Post a Comment